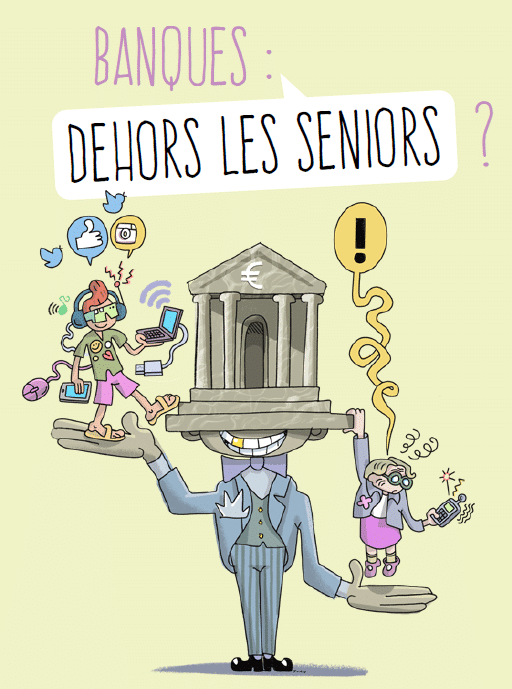

Left out of the digital loop

The suppression of self-banking machines will have direct consequences on the older population, considering that 27% of 55-74 year olds have never used e-banking, and 42% of seniors aged 75 and over in Wallonia is not be connected to the Internet. Yet these figures that include older people over 74 years old are exceptional for the majority of studies on digital exclusion do not include them. For Énéo, this gap in data does not allow a completely relevant view of the digital divide among seniors and reveals once again the invisibility of this population group.

‘After the age of 75, they are no longer even considered as potential users of digital tools!’ said Violaine Wathelet.

People living in remote areas or with mobility limitation will be particularly affected. Where before it was possible to walk to a bank branch to make a bank transfer, you will have to walk tens of kilometres to do so. This is a real issue when you don’t have a car and when public transport is scarce or non-existent where you live. And if manual operations have not (yet) totally disappeared, they now represent a significant cost.

Digital or nothing

The abolition of self-banking terminals is not an anecdote, insists Énéo’s policy secretary. It is a clear demonstration of the primacy of digital technology in our social practices. And the current health crisis has greatly accentuated this trend.

“The fight should not be against this digitalisation but against its overwhelming exclusivity.”

“Let us not forget that the basic banking function is not just a commercial activity. It is a public service entrusted to operators who must assume the delegated public mission they perform in the service of citizens”, conludes Mrs Wathelet.

Read the full article (in French)

Learn more about Énéo’s campaign on their website (in French)