BETTER FINANCE has released the eighth edition of its report on the Real Return of Long-Term and Pension Savings.

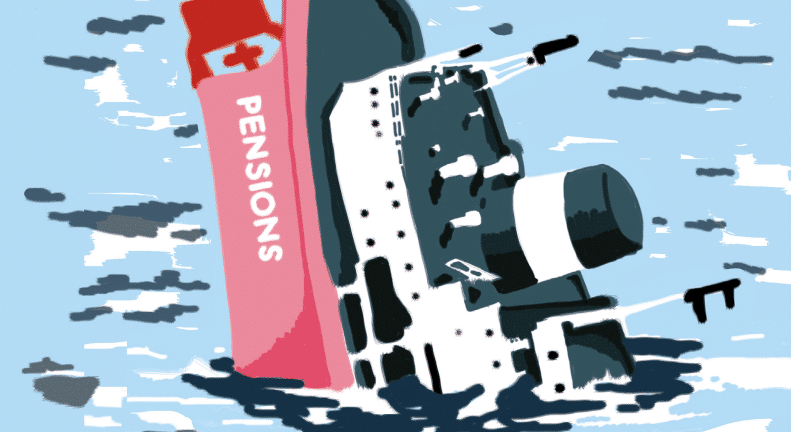

The report reveals that despite better performances in 2019, poor real long-term returns persist. Too many pension schemes still reveal negative or very low long-term returns once charges and inflation are deducted. In addition, since the end of 2019, these assets have dropped in value, and today’s severe recession generates a slowdown in pension contributions.

In its press release, BETTER FINANCE once again raises the alarm and calls for a reform of pension and capital market policies to mitigate the effects of the health crisis on pension adequacy.

BETTER FINANCE put forward a number of key policy recommendations to ensure decent long-term returns for private pensions. Those recommandations includie:

- Harmonise and reinforce rules to effectively curb conflicts of interests in the distribution of long-term and pension savings products.

- Restore standardised long-term and relative past performance disclosure for all long-term and retirement savings products.

- Grant special treatment through prudential regulations for all long-term & pension liabilities (eliminate the debt bias).

- Simplify the “basic PEPP” and allow direct investments into capital markets (plain vanilla stocks, bonds index ETF) for PEPP savers.

- Urgently impose harmonised and comprehensive insurance guarantee schemes across the EU since a majority of personal pensions are insurance-based and -regulated.

Access the full report ‘Long-Term and Pension Savings – The Real Return’

A simplified booklet of the Pensions Report with the main findings and recommendations is also available, as well as a table presenting the annual average performances of the pension products covered by the report by country.