As he was tired of the difficulties he faced every time he went to his bank to manage his account, a 78-year-old Spanish retired doctor recently launched a campaign urging for making the access to banking services easier to older people. Following the success of the campaign, the reaction of banks had not been long in coming.

“I went home several days without being able to get any money. I had no access to the office because I had to make an appointment beforehand and I was referred to an app”. Carlos San Juan

The rapid digitalisation of banking services excludes the many people, mostly older people, who do not have the digital knowledge needed to use them. The digital exclusion is aggravated in many rural areas with a poor internet connection.

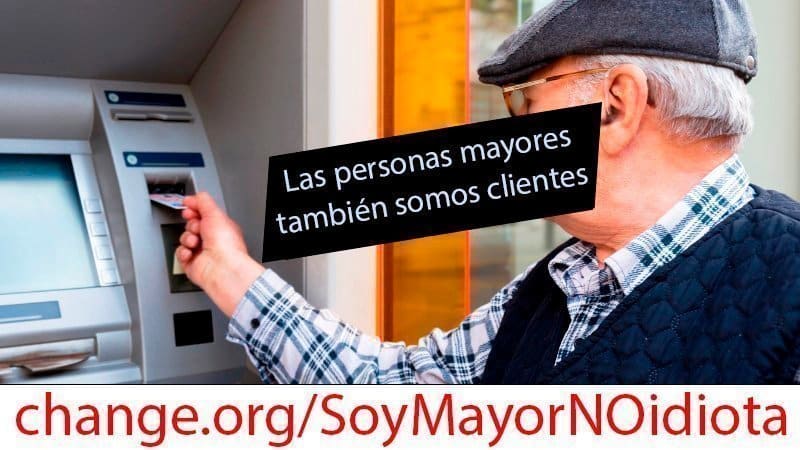

In Spain Carlos San Juan launched the campaign ‘I am a senior citizen, not an idiot’ through the Change.org application. In a matter of a few days, he collected more than 600,000 signatures, which he presented to the Ministry of Economy and the Bank of Spain, as the banking regulatory agency.

As a reaction, the largest banks committed themselves to extending opening hours and ensuring personalised treatment for older customers who request it.

They signed a protocol agreeing on the following measures:

- Face-to-face service in the offices: The opening hours will be extended from at least 9:00 to 14:00 h (9:00 to 11:00 before).

- Priority access for the over 65s and people with disabilityin the event of a high number of customers,

- Training for their staff on the needs of this group.

- Telephone customer service offered with no additional cost to older people and people with disabilities, from 9:00 am to 6:00 pm.

- Cash machines, APPs and websites: Their adaptability and accessibility will be reviewed and adapted as necessary.

- Training: Banks commits to reinforce financial, digital and fraud prevention education for this group, through the most appropriate channels for them.

- Monitoring: The Financial Inclusion Observatory will be responsible for monitoring these measures. It will gather information from the institutions to draw up a half-yearly report.

Growing dissatisfaction

A recent survey published by the daily publication ‘+65’ shows that 70% of customers aged 50+ are dissatisfied with their banks. Training is undoubtedly the task pending for both public administrations and financial institutions. Only 12% say that they have received some kind of course from their bank.

The so-called digital barrier does not only affect the relationship between citizens and banks. The same problem can be found in relations with the authorities when it comes to fulfilling tax obligations, making appointments for health care, etc.

Mobilisation pays off

The example of Carlos San Juan shows that it is time for Europe’s seniors to stand up and demand acceptable treatment for seniors, who constitute a huge group in terms of numbers and level of savings. According to statistics, the savings of senior citizens in banking exceed 500,000 million euros, reaching +40% of customers in rural areas.